Robots: China breaks historic records in automation

China forecast 2020 – IFR predicts annual sales increase between 15 and 20 percent on average

China has rapidly become a global leader in automation. From 2018 to 2020, a sales increase between 15 and 20 percent on average per year is possible for industrial robots. Annual sales volume has currently reached the highest level ever recorded for a single country: Within a year, sales in China surged by 27 percent to 87,000 units (2016). The operational stock of industrial robots marks the highest level in the world. At the same time, Chinese robot manufacturers expand the market share in their home country.

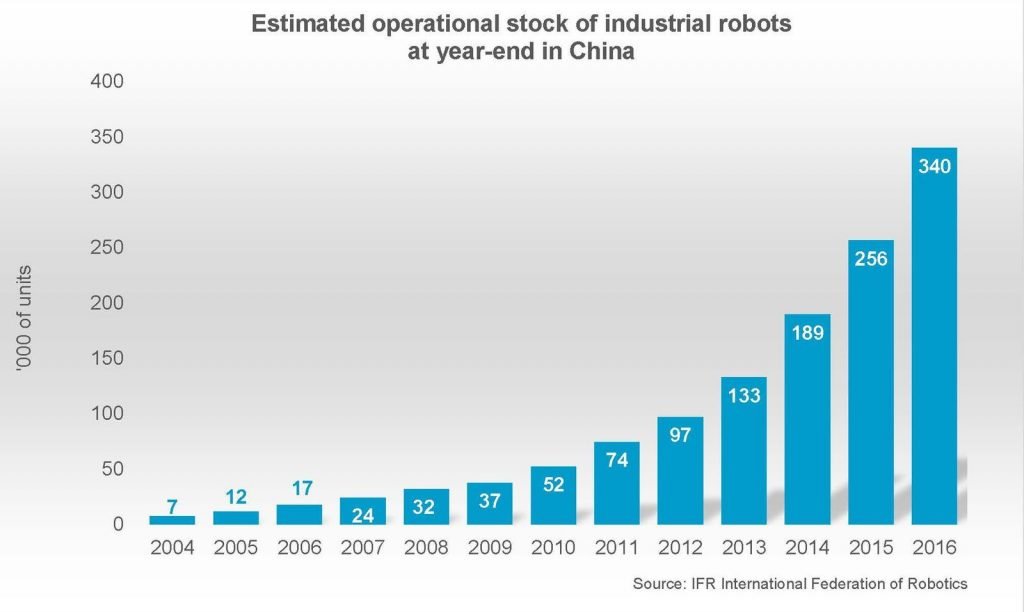

Operational stock of industrial robots in China from 2004 to 2016

“China is by far the biggest robot market in the world regarding annual sales and regarding the operational stock,” said Joe Gemma, President of the International Federation of Robotics (IFR). “It is the fastest growing market worldwide. There has never been such a dynamic rise in such a short period of time in any other market.”

Electrical and electronics industry are the main drivers

The main drivers of the latest growth in China are the electrical and electronics industry. Sales increased by 75 percent to almost 30,000 units (2016). About one third of the robots were produced by Chinese robot suppliers, who more than doubled sales by almost 120 percent. All international robot suppliers also increased sales considerably to the electrical and electronics industry (+59 percent). This remarkable demand will further grow in the future. Major contract manufacturers of electronic devices have already started to automate production. The semiconductor and the chip industries, for example, have strongly invested in automation. Large battery production facilities are being installed to meet the increasing demand for electric and hybrid cars.

Car industry lost its pole position

The automotive industry lost its pole position to the electrical and electronics industry, but is still a powerful driver for industrial robot sales. China has become both the world’s largest car market and the world’s largest production site for cars – including electric cars – with much growth potential. Sales to China made up 25 percent of the global supply of industrial robots to the automotive industry in 2016. Between 2011 and 2016, a total of 108,000 units were installed, representing an average increase of 18 percent per year. The market share of Chinese robot suppliers in the automotive industry is still on a rather low level but has increased from 10 to 13 percent. China is the largest growing consumer market with increasing demands for all kinds of consumer goods. Consequently, various other industries have also started to expand capacities and automate production.

Some international robot suppliers have already launched production plants in China and in all likelihood more will follow suit in the coming years. Most industrial robots in China are imported from Japan, Korea, Europe, and North America.

China outlook 2020

The Chinese government wants to transform China from a manufacturing giant into a world manufacturing power according to the ten-year national plan “Made in China 2025”. The plan includes strengthening Chinese robot suppliers and further increasing their market shares in China and abroad. China intends to forge ahead and make it into the world’s top 10 most intensively automated nations by 2020. By then, its robot density is targeted to rise to 150 units – this being the number of industrial robots per 10,000 employees. Today, Asia is the leader regarding robot density is South Korea, with 531 robot units. In the Americas, it is the USA with 176 robot units and in Europe, it is Germany with 301 robot units.

IFR China data overview

Please find below an overview of the new IFR preliminary data about industrial robots in China:

China – new peak in 2016

Sales

- 87,000 new robots installed (thereof, about 27,000 from Chinese suppliers), 27% more than in 2015

- CAGR 2011-2016: +31%

- Global ranking 2016: No. 1

- Shares of total supply:

Handling operations 45%, welding 26%

Electrical/electronics industry 35%, automotive industry 30%

Stock of operational robots

- About 340,000 units, 33% higher than 2015

- CAGR 2011-2016: +36%

- Global ranking 2016: No. 1

These are results published by the International Federation of Robotics (IFR) ahead of the World Robotics Report 2017 to be released on September 27th.

Source: IFR

Photo/video source: IFR

Recent Comments